December 15, 2025

Spot rates settle a bit in the latest week

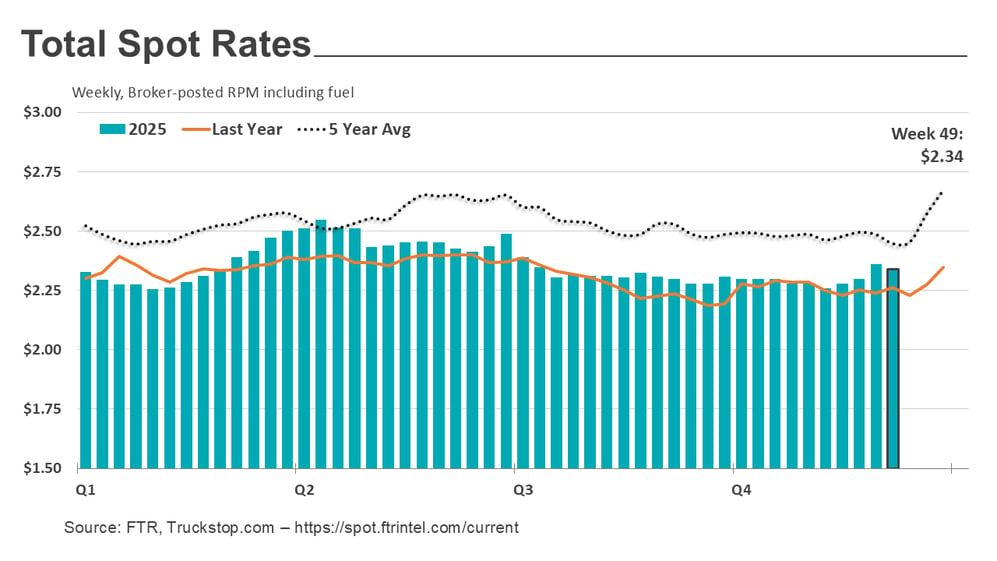

The total broker-posted spot rate in the Truckstop.com system declined for the first time in four weeks during the week ended December 12 (week 49) as refrigerated spot rates gave back most of the prior week’s big gain and dry van spot rates decreased slightly after five straight weeks of increases. Flatbed spot rates were up for a fourth straight week to their strongest level in 10 weeks. Spot rates for each of the three principal equipment types were up just over 4% versus the same 2024 week.

Total load activity declined 4.9% after the big rebound that occurred during the week after Thanksgiving. Other than the previous week, volume was the strongest since the week after International Roadcheck week in May. Loads were 20% higher than in the same week last year. Truck postings increased 1.8%, and the Market Demand Index – the ratio of loads to trucks – declined modestly after reaching its highest level since International Roadcheck in May week during the prior week.

The total market broker-posted rate declined 1.7 cents after rising 5.6 cents during the previous week. Rates were 3.5% higher than they were during the same 2024 week as a softer prior-year comparison for the low-volume specialized equipment type diluted gains in the three principal equipment types a bit. The current week (week 50) usually sees further softening of spot rates before lack of capacity invariably results in rate increases for all equipment types during the week that includes Christmas. Spot rates for dry van and refrigerated equipment also typically post strong gains during the week between Christmas and New Year’s Day, but flatbed rates generally soften.

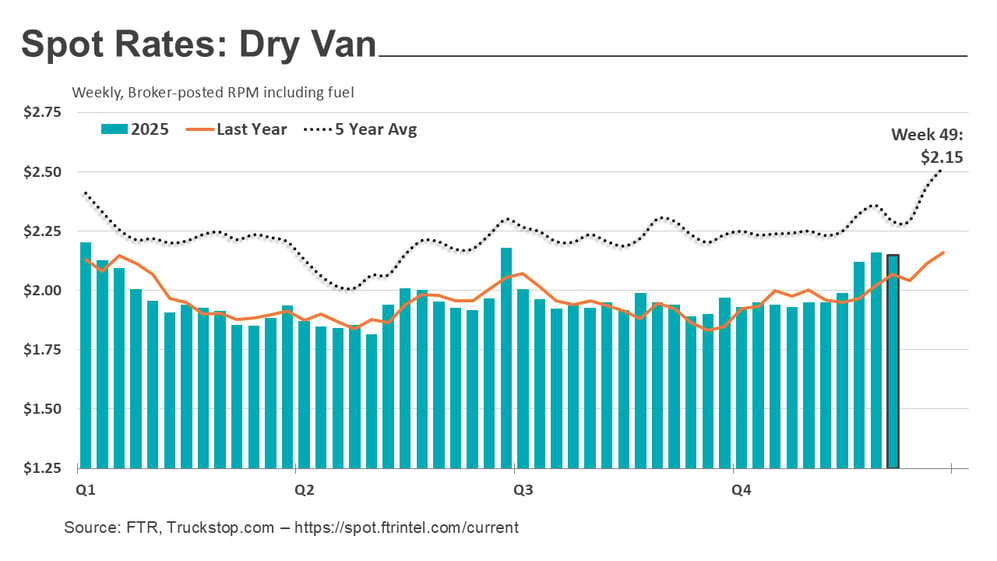

Dry van spot rates declined just under a cent after rising just over 4 cents in the prior week. Rates were just over 4% higher than in the same 2024 week but 6% below the five-year average. Dry van loads declined 3.7% after the big post-holiday rebound in the previous week. Volume was 17% higher than in the same 2024 week but about 15% below the five-year average for the week. Although rates were down, they were far more resilient than usual as dry van rates over time have fallen, on average, around 10 cents during comparable weeks.

Refrigerated spot rates fell 18.5 cents after soaring just over 21 cents during the previous week. Rates were a little more than 4% above the same 2024 week but about 2% below the five-year average for the week. Refrigerated loads were down 10.7% after the big jump in the week after Thanksgiving. Volume was about 10% lower than in the same 2024 week and close to 23% below the five-year average for the week.

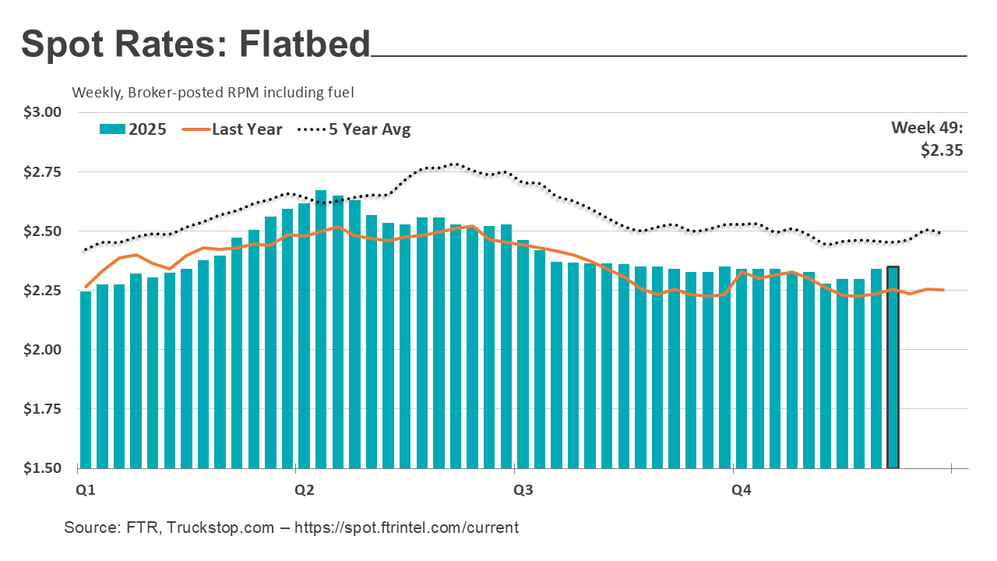

Flatbed spot rates increased just over 1 cent after rising nearly 4 cents in the prior week. Rates were just over 4% higher than in the same 2024 week but more than 4% below the five-year average for the week. Flatbed loads eased 5.0% after the post-holiday surge in the previous week. Load volume was 34% higher than more than in the same 2024 week and nearly 7% higher than the five-year average for the week.

Dive deeper into this week's data!

View the Spot Market Insights interactive dashboard!

Go beyond the data with the minds of FTR & Truckstop

Updated weekly on Tuesday, FTR's Avery Vise analyzes Truckstop data and more.

Updated weekly on Tuesday, FTR's Avery Vise analyzes Truckstop data and more.

-1.png?width=1000&height=1000&name=Untitled%20design%20(4)-1.png) Truckstop's Brent Hutto dishes on spot market activity and other hot topics.

Truckstop's Brent Hutto dishes on spot market activity and other hot topics.