March 2, 2026

Spot rates remain quite elevated in the latest week

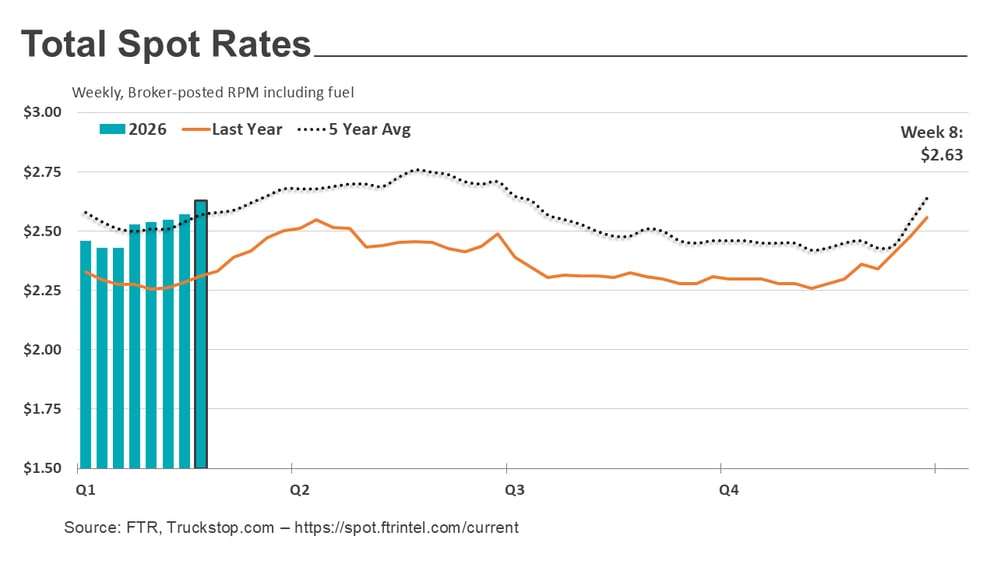

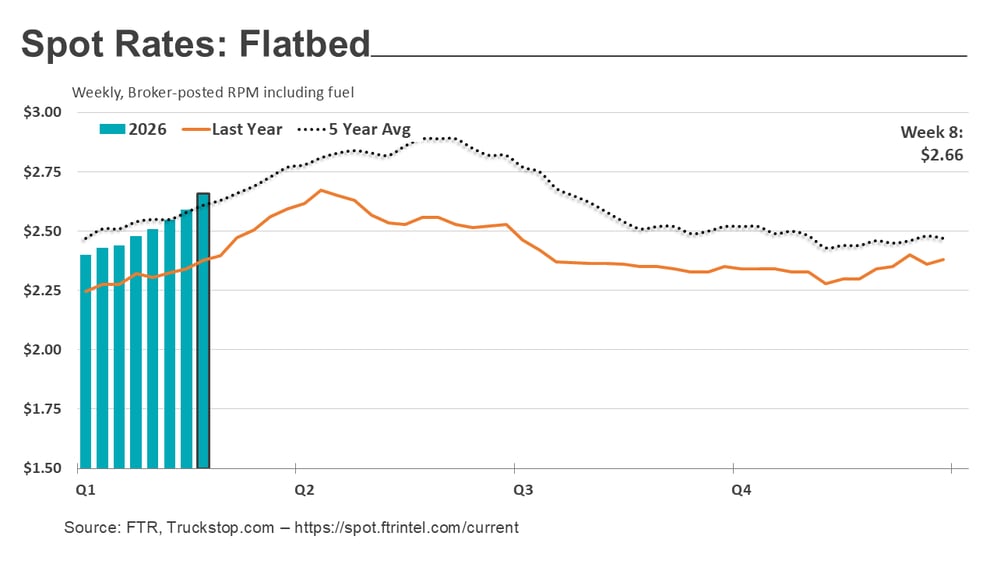

Overall broker-posted spot rates in the Truckstop.com system rose notably during the week ended February 27 (week 8) as rates for both flatbed and dry van equipment moved higher and refrigerated rates posted their smallest decrease since the 45-cent spike in week 4. Spot rates for all three principal segments were quite strong versus the same week last year. The latest week included some strength linked to a winter storm in the Northeast, but weather will become an increasingly insignificant factor.

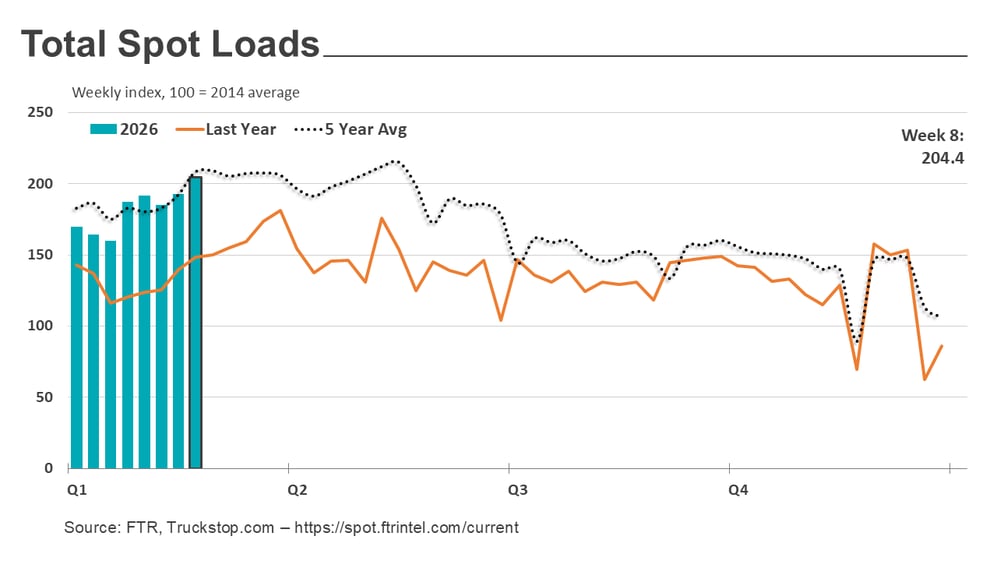

Total load activity increased 6.0%, again reaching the highest level since July 2022. Load postings were close to 38% higher than during the same 2025 week. Flatbed continues to post the largest year-over-year comparisons, but dry van volume also was quite strong versus the same week last year.

Truck postings increased 1.7%, and the Market Demand Index – the ratio of loads to trucks – rose to the highest level since March 2022.

The total market broker-posted rate increased 5.7 cents to the highest level since the final week of 2022 due mostly to flatbed, though dry van spot rates also inched higher. Total rates were almost 14% higher than in the same 2025 week – the strongest prior-year comparison since March 2022.

Although weather disruptions should be few and far between now, seasonal firming coupled with ongoing stress in capacity likely will keep spot rates strong. It increasingly appears that the major week 4 weather disruption rapidly triggered a reset in spot rates that might have occurred more gradually this spring. If so, the market impact of January’s winter storm is comparable to that from Hurricane Harvey in September 2017.

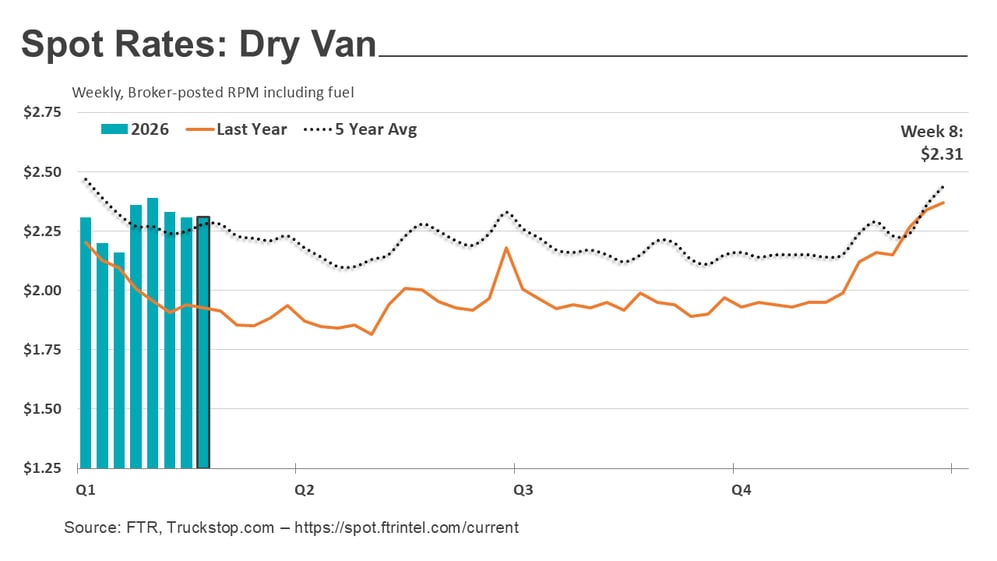

Dry van spot rates ticked up nearly 1 cent after declining nearly 9 cents over the prior two weeks. Rates, which were nearly 16 cents higher than they were the week before the major weather event, were 20% higher than in the same week last year. The impact from last week’s winter storm was apparent as dry van rates in the Northeast jumped just under 14 cents while rates declined in several regions. The largest increase other than in the Northeast was just over 3 cents in the Southeast.

Dry van loads increased 1.7%. Volume was close to 29% higher than in the same 2025 week. Load volume jumped more than 21% in the Northeast. The strongest increase elsewhere was more than 5% on the West Coast while several regions saw lower volume.

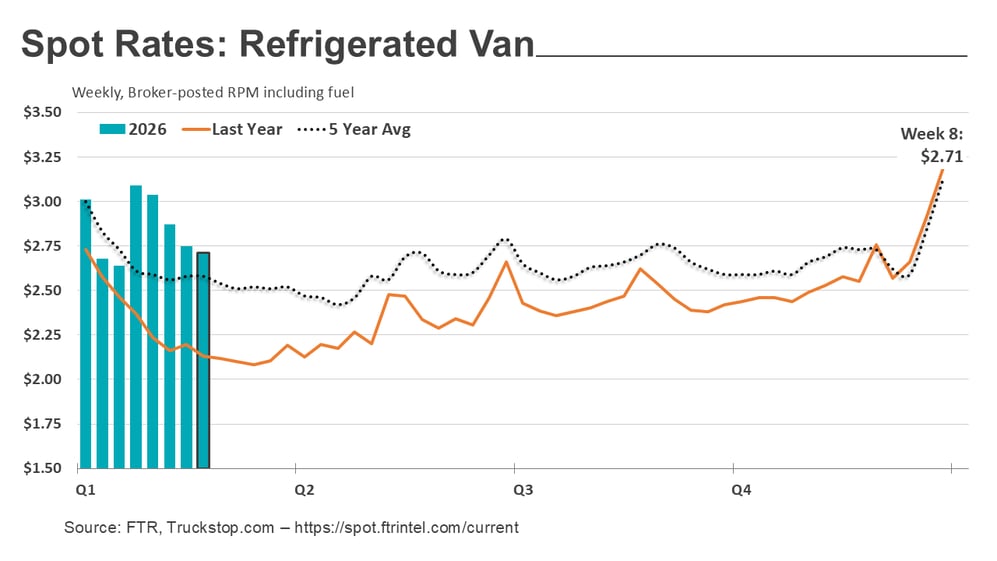

Refrigerated spot rates declined 3.6 cents. Rates were only about 7 cents higher than they were before the weather event, but in a normal year they would be well below week 3 levels by week 8. Moreover, refrigerated rates were about 27% higher than they were in the same 2025 week. Rates increased in the Northeast and South Central regions but were down elsewhere.

Refrigerated loads increased 6.1%. Load volume was a little more than 5% higher than in the same week last year. Volume rose sharply in the Northeast and Southeast but also was up in other regions except the Midwest, which saw a small decline.

Flatbed spot rates rose just under 7 cents to their highest level since April. That rate, in turn, had been the highest since October 2022. Flatbed rates have risen in 14 of the past 15 weeks and were just under 12% higher than they were in the same 2025 week for the strongest prior-year comparison since April 2022. The strongest rate increases were in the Northeast followed by the Midwest and the West Coast.

Flatbed loads increased 6.9% to their highest level since June 2022. Load postings were more than 49% higher than in the same 2025 week. Loads rose sharply in the Northeast and South Central regions, but all other regions saw gains except the West Coast.

Dive deeper into this week's data!

View the Spot Market Insights interactive dashboard!

Go beyond the data with the minds of FTR & Truckstop

Updated weekly on Tuesday, FTR's Avery Vise analyzes Truckstop data and more.

Updated weekly on Tuesday, FTR's Avery Vise analyzes Truckstop data and more.

-1.png?width=1000&height=1000&name=Untitled%20design%20(4)-1.png) Truckstop's Brent Hutto dishes on spot market activity and other hot topics.

Truckstop's Brent Hutto dishes on spot market activity and other hot topics.