January 20, 2026

Van spot rates fall sharply again in the latest week

Post-holiday normalization in the spot market continued in the latest week. Broker-posted spot rates in the Truckstop.com system for dry van and refrigerated van equipment both fell during the week ended January 16 (week 2) by considerably more than they did in the previous week and by more than they typically do in comparable weeks. Flatbed spot rates were the highest since mid-year. Van spot rates usually continue falling in week 3, although weather can be disruptive as was the casein 2024’s week 3.

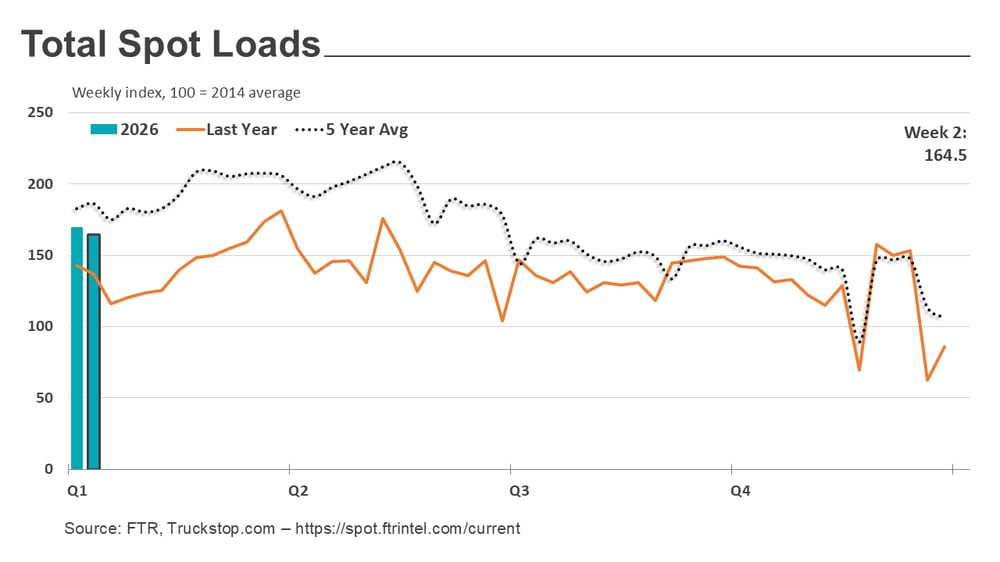

Total load activity was basically stable, declining 3% week over week after spiking nearly 97% following the holidays. Due solely to flatbed, load postings were about 20% higher than in the same 2025 week but were nearly 12% below the five-year average for the week. Truck postings rose 6.8%, and the Market Demand Index –the ratio of loads to trucks – fell from week 2’s extreme level but was otherwise the strongest since May 2022.

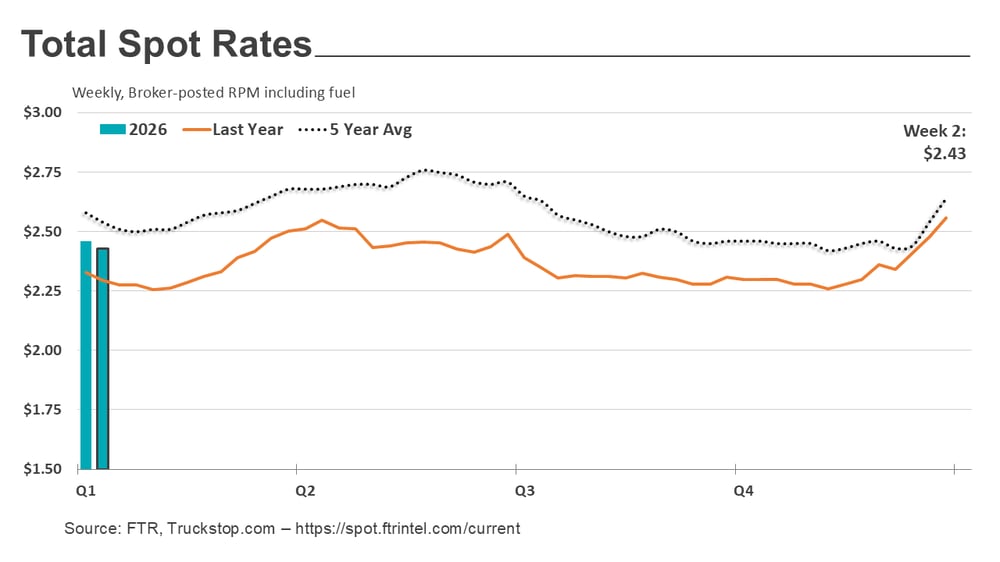

The total market broker-posted rate decreased more than 3 cents after falling more than 9 cents during the previous week. Total rates were about 6% higher than in 2025’s week 2 but more than 4% below the five-year average for the week. On a year-over-year basis, flatbed spot rates were stronger than dry van spot rates for the first time since mid-November and were stronger than refrigerated spot rates for the first time since late October.

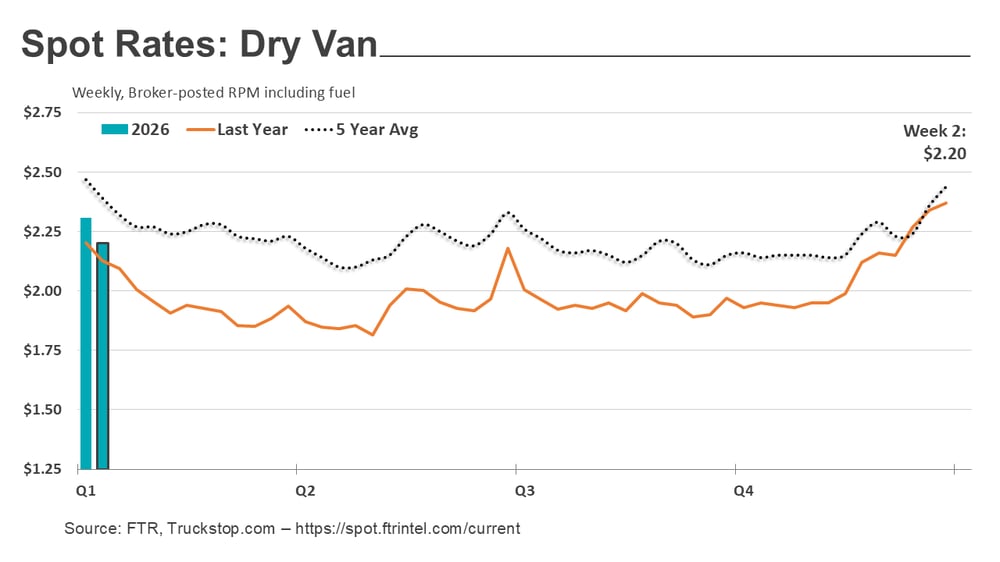

Dry van spot rates fell about 10 cents after decreasing nearly 7 cents in the prior week. The week-over-week decrease has been exceeded several times in week 2 over the years but it is larger than usual. Rates were 3.6% higher than in 2025’s week 2 but nearly 7% below the five-year average for the week. Dry van loads fell 16.1%. Volume was 5.4% below that in 2025’s week 2 and about 36% below the five-year average for the week.

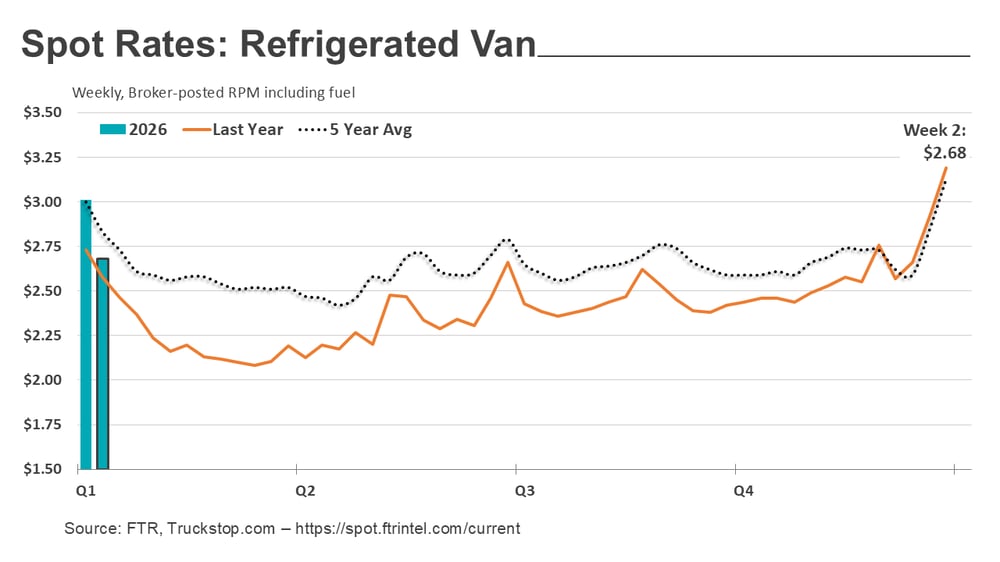

Refrigerated spot rates plunged just over 33% cents – the most by far during week 2 going back to at least 2008. After surging 62 cents in three weeks during December, refrigerated spot rates have fallen nearly 52 cents in two weeks. Rates were 3.8% higher than in 2025’s week 2 but 5.5% below the five-year average for the week. Refrigerated loads fell 26.7%. Volume was nearly 21% below that in 2025’s week 2 and close to 47% lower than the five-year average.

Flatbed spot rates increased about 3 cents and have risen in eight of the past nine weeks for a total of 15 cents. Rates were about 7% higher than in 2025’s week 2 but were 3% below the five-year average. Flatbed loads rose 10.5% to their highest level since the beginning of April. Load volume was close to 50% above that during 2025’s week 2 and about 15% above the five-year average.

Flatbed spot rates increased about 3 cents and have risen in eight of the past nine weeks for a total of 15 cents. Rates were about 7% higher than in 2025’s week 2 but were 3% below the five-year average. Flatbed loads rose 10.5% to their highest level since the beginning of April. Load volume was close to 50% above that during 2025’s week 2 and about 15% above the five-year average.

Dive deeper into this week's data!

View the Spot Market Insights interactive dashboard!

Go beyond the data with the minds of FTR & Truckstop

Updated weekly on Tuesday, FTR's Avery Vise analyzes Truckstop data and more.

Updated weekly on Tuesday, FTR's Avery Vise analyzes Truckstop data and more.

-1.png?width=1000&height=1000&name=Untitled%20design%20(4)-1.png) Truckstop's Brent Hutto dishes on spot market activity and other hot topics.

Truckstop's Brent Hutto dishes on spot market activity and other hot topics.